UK heat pump statistics

Are you looking for statistics on UK heat pump installations and market growth? Then look no further.

We have carefully selected, reviewed and organised a list of statistics below. Either jump straight to a category or keep reading for UK heat pump statistics.

UK heat pump installation statistics

These statistics show how the UK Government is doing with heat pump installation against the UK’s target.

- In 2021 the UK Government published its Net Zero strategy with a target to reach net zero greenhouse gas emissions by 2050 (UK Government).

- The UK Government’s Net Zero strategy stated its ambition that by 2035 no new gas boilers will be sold. (UK Government)

- The UK Government Heat and Buildings Strategy 2021 set a heat pump installation target of 600,000 a year by 2028. This represents 2.5% of UK homes. (UK Government)

- According to the UK Parliament, only around 72,000 heat pumps were installed in 2022. This falls woefully short of the government’s target. (UK Parliament)

- To date only 370,000 heat pumps have been installed in the UK. (European Heat Pump Association (EHPA))

- At the current rate of installation it would take 700 years to hit the UK Government’s heat pump installation target. (UK Energy Research Centre)

- Only 5% of the UK’s total heat pump demand in buildings is currently met by low-carbon heating. (UK Energy Research Centre)

- In 2022 France within the EU, France sold the most heat pumps. 621,776 were sold in France, compared to only 55,168 in the UK (EHPA)

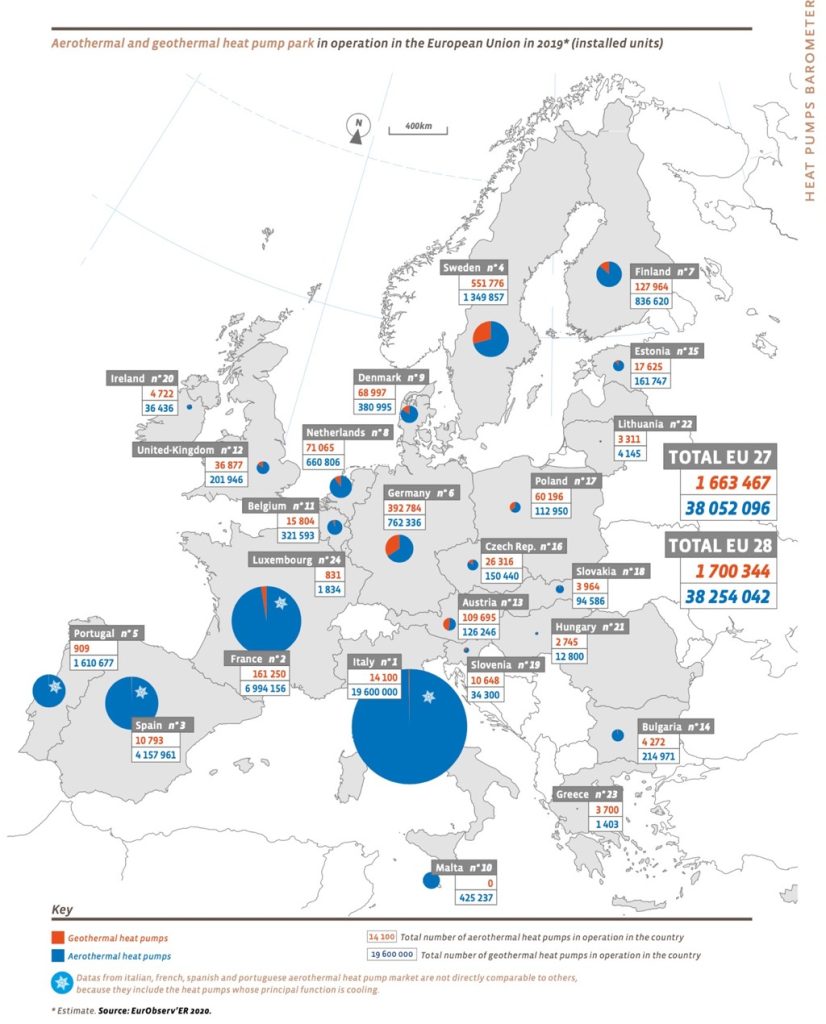

- Air-source heat pumps are the most common type of heat pump installation in the UK

- Within air source heat pump installations, air to water heat pumps represent 90% of all heat pumps installed. (EurObserver)

- There are around 3000 heat pump installers in the UK. This is far short of the 27,000 required by 2028 to meet the Government’s target. (NESTA)

- The UK will need to train 5000-7000 installers in the next decade if it wants to meet its target (NESTA).

Statistics on the use of heat pumps in the UK

These statistics relate to heat pumps and UK carbon emissions and energy usage.

- Heating accounts for 14% of UK carbon emissions (Institute for Government)

- In the UK, the amount of energy from heat pumps used to generate heat has grown rapidly. By 2022 this was the equivalent of 1.2 metric tonnes of oil (Statista)

- Trials in the UK have suggested that heat pumps have an average seasonal performance factor of between 1.9 and 2.8 (UK Parliament). European trials have fared much better with Superhomes in Ireland achieving an SPF of 3.35.

- One of the reasons for this may be the inferior insulation in UK homes. This is among the worst in Europe (Flower et al 2020).

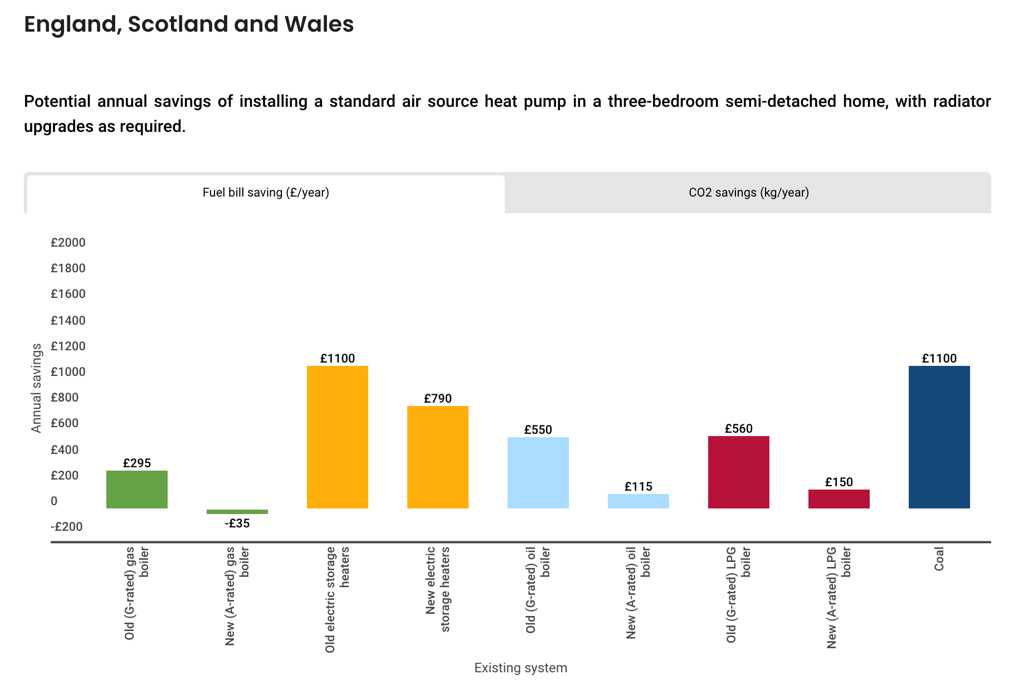

- The Energy Savings Trust estimates that UK home could enjoy cost savings of around £295 pounds a year on their heating bills vs an old G rated gas boiler (Energy Savings Trust). This rises to £1100 against old electric storage heaters. NB – at the time of writing (Nov 23) the average price per KwH of electricity is three times that of gas – meaning electricity bills are relatively more expensive. We expect this to fall in the coming years.

- For homeowners looking to reduce their carbon footprint, the Energy Saving Trust also estimates that they can save around 4,400 kg/year by switching from a gas boiler to a heat pump.(Energy Savings Trust)

UK heat pump cost statistics

These statistics relate to UK households and the cost of heat pumps (installation and running costs).

- Air source heat pump installation in the UK for residential buildings costs between £3,000 and £12,000 depending on the technology used. However the final upfront cost can be much higher once you take upgrades to radiators and insulation into account. (WeLoveHeatPumps)

- According to the figures produced by the UK Government Boiler Upgrade Scheme, the mean cost of air source heat pump installation was £13,259 between May22 to September 2023. (UK Government)

- It would be realistic to see a reduction of between 15-25% on the installation cost by 2030 (NESTA)

- Installation costs across the world as a whole have reduced, but the reduction in the UK has been much slower than other countries. Median costs in the year 2015-2019 for the RoW have reduced by 22% compared to just 9% in the UK. (UK Energy Research Centre (UKERC))

- Good insulation is essential to meet the potential of heat pumps. Almost all of the UK’s 29M homes need insulation upgrades, with 19,000 UK homes receiving energy efficiency measures every week (UKERC)

- In 2021 only 49% of English dwellings had cavity walls with insulation. (English Housing Survey)

- In 2021, 25% of English homes were constructed from uninsulated solid walls. (English Housing Survey)

Attitudes to heat pumps in the UK

These statistics reflect UK opinion on the installation of heat pumps. They illustrate some of the market barriers to heat pump adoption in Great Britain.

- In 2023, 86% of people surveyed in the UK said they were aware of the need to change the way that homes are heated to reach Net Zero targets. However only 37% had ‘a fair amount’ or ‘a lot’ of awareness. (DESNZ Public Attitudes Tracker: Heat and Energy in the Home Summer 2023)

- The 16-24 age group was most aware. Those above 55 were the least aware. (DENSZ)

- In Winter 2022 only 16% of those surveyed were very likely or fairly likely to install an air source heat pump. 27% said that they did not know enough about the technology to make a decision (DENSZ).

- In winter 2022, 57% of owner-occupier households, reported that they were unlikely to install a low carbon heating system. Cost of installation was the main concern (45%). Other large concerns were wanting to wait to see how the technology developed (32%) and the suitability of their home (30%) (DENSZ).

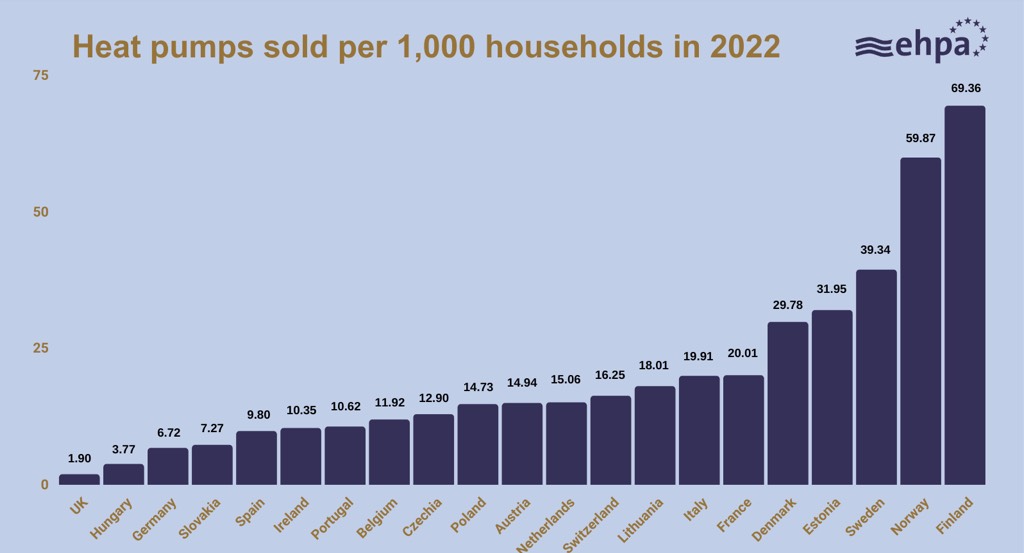

UK and European Heat pump market

These statistics show the UK and European heat pump market.

- The five biggest heat pump markets in the European Union last year were France (621,776 units sold), Italy (513, 535 units sold), Germany (275,697 units sold), Sweden (215,373 units sold) and Finland (66,984 units sold). (EHPA)

- In comparison there were 55,000 sold in the UK with 72,000 heat-pump installations. (UK Parliament)

- France is currently 6 years ahead of the UK’s heat pump installation target. (MCS Charitable Foundation)

- In France, the leading market in Europe, air to air heat pumps account for around 2/3 of all heat pumps sold. (EHPA)

- The comparative success of heat pump installation in France has been put down to a number of factors including cheaper nuclear electricity, a well-established air conditioning market, a more advanced supply chain and less friction in policy and regulation (MCSCF)

- When looking at heat pumps sold per household, the UK is bottom of all European countries surveyed. There were 1.90 heat pumps sold per 1000 households in the UK in 2022. In Finland this figure was 69.39. (EHPA)

Statistics for funding packages in the UK

The Boiler Upgrade Scheme provides funding for homeowners in England and Wales who are looking to switch to low carbon technologies when heating their homes. These statistics show the uptake of this funding package and various government schemes – including those in Scotland.

- The Boiler Upgrade Scheme opened to voucher applications in May 2022, with approved funding of £450M up to 2025 (UK Government)

- Between May to September 2023, 24,088 the UK Government received 24,088 voucher applications. They issued 21,020 vouchers over the same period. (UK Government)

- 96% of the voucher applications in the period were for air source heat pumps. (UK Government)

- 3% of the voucher applications in the period were for ground source heat pumps (UK Government)

- The highest uptake for these government grants was in the the South East and South West of England. The lowest uptake was North East of England. (UK Government)

- 48% of air source heat pump installations were replacing natural gas boilers. (UK Government)

- 21% of air source heat pump installations were replacing oil fired boilers. (UK Government)

- Air source heat pumps are slightly more popular in rural areas at 57% compared to 45% in urban areas (UK Government)

- Many fewer ground source heat pumps were installed in urban areas. They accounted for only 16% of all ground source heat pump vouchers issued (UK Government).

- In December 2022, The Scottish Government introduced the Home Energy Scotland Grant and Loan scheme. The scheme provides grants and interest-free loans for homeowners looking to switch from fossil fuels to renewable sources. Between December 2022 and Jan 2023 there were 3262 grants and loans offered in Scotland under the scheme. 43% of these were loans, 24% of these were grants, with the remainder being a hybrid of the two. (Scottish Government)

UK heat pump statistics in summary

We hope that this article has provided a good overview of UK pump statistics. At WeLoveHeatPumps we are passionate about reducing our dependance on fossil fuel boilers and helping the rollout of clean heating in the UK.

If you are considering switching to a heat pump, we encourage you to explore some of the in depth articles on the website. To find out whether a heat pump could be right for your house, please check our article on the suitability of your home.

For more information on running and installation costs, please check out our article ‘how much does an air source heat pump cost‘. For more information on funding options in the UK, please see our page on the various government subsidies available.